Challenge:

Asset management companies often struggle with responding to Due Diligence Questionnaires (DDQs) from investors or institutional partners. These documents can contain hundreds of critical questions, and the process of answering them accurately and quickly is a major operational bottleneck. The challenge isn’t just the volume—it’s the cross-departmental coordination required to fetch accurate responses from compliance, legal, operations, and investment teams. The slower the turnaround, the more likely firms are to lose competitive ground in closing deals or instilling investor confidence.

Solution:

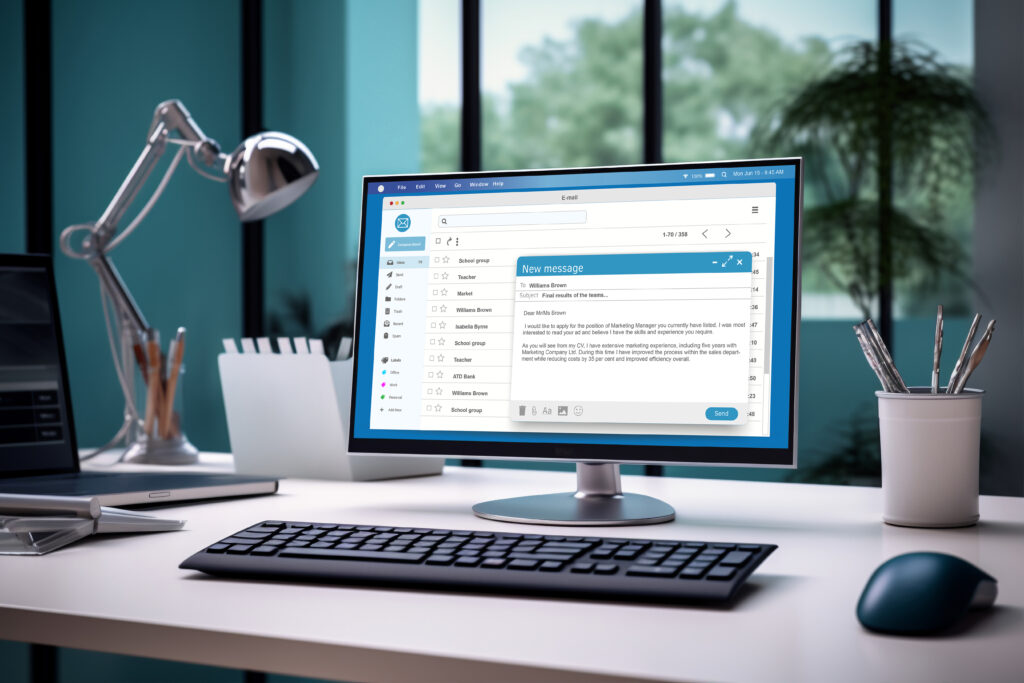

Cracking Tech developed an AI-powered DDQ automation system for NexusAIMS. The platform ingests entire DDQ documents—whether structured or unstructured—and intelligently parses each question. It then automatically retrieves answers from an internal repository of fund-related documents (prospectuses, reports, compliance records, etc.) using generative AI. The system is smart enough to understand contextual dependencies between questions, ensuring that answers remain consistent and coherent across the document. At the end, the user receives a completed DDQ—accurate, consistent, and generated in record time.

The Impact

Reduced manual coordination between departments

Enabled intelligent, document-aware responses

Minimized human error in complex fund documentation

Accelerated investor engagement and fund placement

Transformed a week-long task into a matter of minutes

Tech Stack

![django-logo-positive-[Converted]](https://crackingtechco.com/wp-content/uploads/2025/06/django-logo-positive-Converted-300x106.png)

Result

The implementation of this AI-driven DDQ responder significantly streamlined NexusAIMS’ due diligence workflow. What used to take days of cross-team coordination is now handled in minutes, reducing response time by over 85%. The system answered over 95% of questions without manual input, allowing business teams to focus on strategy rather than paperwork. Investor confidence rose due to the speed and consistency of responses, directly leading to faster fund commitments and improved client trust.